Tourist tax in Canada A complete guide

Canada, renowned for its stunning natural wonders, bustling cities, and diverse culture, attracts millions of visitors each year. In this guide to the tourist tax in Canada, we cover everything you need to know about who needs to pay the tax, the applicable rates, and how to stay compliant with ease. Whether you're visiting or managing accommodation, understanding Canada’s tourist tax can help make your stay or hosting experience smoother.

Why do local governments in Canada levy a tourist or lodging tax?

Municipalities maintain many public facilities that are used by tourists. Examples include cleaning beaches, parks and streets, the development of public transport, as well as maintaining them. Many municipalities levy a tourist tax as a contribution to these costs.

Tourist tax by municipality in Canada

There are different types of tourist taxes in Canada, also called lodging taxes. These also vary by province. For example, there's the Accommodation Levy (AL), the Marketing Levy (ML), the Municipal Accommodation Tax (MAT, and the Municipal and Regional District Tax (MRDT).

Would you like to know the rules regarding tourist tax per municipality in Canada? Trippz collects all data about tourist taxes. You can read more about the specific tourist tax rules of municipalities in Canada via the overview below:

For Tourists

What kind of taxes do you pay as a tourist in Canada?

When renting accommodation in Canada, you'll encounter various taxes: there are Federal Sales Taxes (GST/HST), Provincial Sales Tax and possibly also regional or municipal tourist taxes.

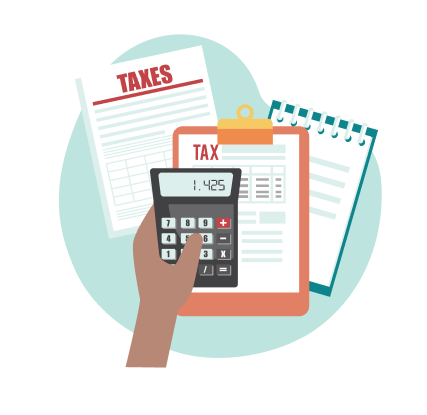

Sales tax in Canada

Everywhere in Canada, a sales tax is charged on the (short) rental of accommodations. The amount and name of this sales tax vary by province. Throughout the country, a minimum of 5% Goods & Services Tax (GST) is applied. Additionally, various provinces levy a Provincial Sales Tax (PST) of 10%. Combined, this is referred to as the Harmonized Sales Tax (HST), amounting to 15%. In Ontario, a different rate of 13% is applied, and Québec charges an additional QST of 9.975%.

In the case of overnight stays, sales tax is only charged if the accommodation price is at least $20 per night. A maximum of 31 consecutive nights is subject to tax, when this is in a residential complex.

An overview of the rates per province:

| Province | GST / HST Rate* | PST Rate |

|---|---|---|

| Alberta | 5% | - |

| British Columbia | 5% | 7% |

| Manitoba | 5% | 7% |

| New Brunswick | 15% | Included in HST |

| Newfoundland and Labrador | 15% | Included in HST |

| Northwest Territories | 5% | - |

| Nova Scotia | 14%** | Included in HST |

| Nunavut | 5% | - |

| Ontario | 13% | Included in HST |

| Prince Edward Island | 15% | Included in HST |

| Québec | 14.975% (GST + QST) | Included in HST |

| Saskatchewan | 5% | 6% |

| Yukon | 5% | - |

*Note: the sales tax is always calculated on top of the local tourist tax.

**From April 1, 2025

Tourist tax in Canada

-

When do you pay tourist tax?

You are considered a tourist when you stay overnight in a municipality where you do not reside, and you pay for accommodation. In such cases, the accommodation provider may be required to charge a tourist tax to the guest and remit it to the municipality.

-

The structure of the tourist tax in Canada

The laws and regulations regarding tourist tax in Canada vary by province, just like the sales tax. Some provinces do not levy a tourist tax, while in others, each municipality may organize the tourist tax under certain conditions. In most cases, the tourist tax in Canada is a percentage of the paid sum for the overnight stay, which is remitted by the host to local authorities.

Provinces without tourist tax

In Northwest Territories, Nunavut, Saskatchewan, and Yukon, no tourist tax is levied. These are currently the less densely populated provinces.

-

Tourist tax in Alberta

The tourist tax in Alberta – called the Tourism Levy – is applicable across the entire province and is remitted to the Tax and Revenue Administration (TRA). Thus, municipalities in Alberta do not have their own rules regarding tourist tax.

The rate of the Tourism Levy is 3.5% of the accommodation price and applies only when the tourist pays more than $30 per night. Additionally, the tourist tax only applies to bookings of less than 28 consecutive nights.

-

Tourist tax in British Columbia

In British Columbia, the local tourist tax is called the Municipal and Regional District Tax (MRDT). This tax is also levied in addition to the sales tax. Thereby, each municipality may determine its own rates. However, the same structures are applied everywhere.

In British Columbia, you are exempt from tourist tax if the accommodation price is less than $20, and in most cases, if you stay for more than 27 consecutive nights in the same accommodation. Additionally, campsites and tents as accommodations are exempt from the tourist tax.

-

Tourist tax in Manitoba

In Manitoba, in addition to the GST and PST, a Local Accommodation Tax is levied in some municipalities.

For this tourist tax, a rate of 5% of the accommodation price is usually charged. Except in Winnipeg, where the rate is 6% of the accommodation price. In the City of Brandon, a rate of $3 per room per night was levied, but this was adjusted in 2023 and aligned with the rest of the province to 5% of the accommodation price.

Fixed places for tents and trailers are exempt from the Local Accommodation Tax. Additionally, some municipalities consider the number of rooms, the accommodation price, and the number of consecutive nights when deciding whether an accommodation must pay tourist tax.

-

Tourist tax in Newfoundland and Labrador

In Newfoundland and Labrador, there is one municipality where a tourist tax has been introduced: St. John's. In addition to the GST and PST (together the HST), an Accommodation Tax of 4% is levied here. Just like the HST, the tourist tax is valid from an accommodation price of $20, with a maximum of 31 consecutive nights. This tax applies to all accommodations.

-

Tourist tax in New Brunswick

More than fifteen municipalities in New Brunswick have introduced a tourist tax. In this province, the tourist tax is called the Tourism Accommodation Levy (TAL), and the amount to be paid is 3.5% of the accommodation price.

The exact laws and regulations differ by municipality. For example, there are municipalities that consider the number of rooms in the accommodation when assessing the tourist tax, with accommodations having less than five rooms for rent being exempt from the Tourism Accommodation Levy. There is also a maximum number of nights for which tax is paid. From the 32nd night, you are exempt from the tax.

-

Tourist tax in Nova Scotia

Several municipalities in Nova Scotia levy the Marketing Levy, as the tourist tax is called in this province. This form of tourist tax has a rate of 3% of the accommodation price.

In Nova Scotia, an exemption is also made for tents and trailers for the tourist tax. Additionally, the same exemptions apply to the Marketing Levy as for the Harmonized Sales Tax (HST): no tax needs to be levied on accommodations that cost less than $20 per night, and you are also exempt from the tourist tax if you stay for more than 31 consecutive nights.

Always stay up to date of the current tourist tax rates

-

Tourist tax in Ontario

Since 2017, Ontario law allows each municipality to levy a tourist tax: the Municipal Accommodation Tax (MAT). A condition for this is that a substantial portion of these proceeds go to a non-profit organization that promotes tourism in the city and/or region.

Since then, more and more municipalities in Ontario have introduced a local tourist tax. In most municipalities, this tourist tax amounts to 4% of the accommodation price, up to a maximum of between 28 and 31 nights. In many municipalities, fixed tents and trailers (provided by the landlord) are exempt from the tax.

Toronto has a different rate. Here, the Municipal Accommodation Tax is set at 6% of the accommodation price.

-

Tourist tax in Prince Edward Island

In Prince Edward Island, there are only two municipalities with a form of tourist tax: the Tourism Accommodation Levy: Summerside and Charlottetown. The tourist tax rate in both municipalities is 3% of the accommodation price and applies to all accommodations.

In Summerside, accommodations with less than ten rooms are exempt from the Tourism Accommodation Levy. This exemption does not apply in Charlottetown. In both municipalities, bookings with more than 31 consecutive nights are exempt from the tourist tax.

-

Tourist tax in Québec

The tourist tax, called Québec Lodging Tax (QLT), in Québec is organized provincially. Municipalities do not have their own rules here. In addition to the GST and QST (Québec Sales Tax), the Québec Lodging Tax is levied.

The QLT rate is 3.5% of the accommodation price, unless the property is rented through an intermediary. In that case, the rate is $3.50 per night. The QLT applies to all accommodations for a maximum of 31 nights. Campsites and youth hostels are exempt from the QLT, so they only pay the sales tax of 5% and 9.975%.

An exception to the QLT is the Nunavik region. In this northern part of Québec, the QLT is not levied.

Frequently asked questions from tourists

-

As a guest, am I responsible for remitting the tourist tax?

No, as a guest, you are not responsible for remitting the tourist tax directly to the municipality. This responsibility typically falls on the accommodation provider or the booking platform (like Airbnb) if you booked through one. They collect the tax from you as part of your payment and are responsible for ensuring that it is correctly remitted to the appropriate authorities. Your role is simply to pay the required tax as part of your stay or on the moment of payment at check-in or check-out.

-

When should I pay the tourist tax?

The tourist tax is typically paid at the time of booking or upon arrival at the accommodation. If you book through an online platform, the tax is often included in the total payment you make during the booking process. If not, you may be required to pay the tax directly to the accommodation provider when you check in.

-

Do I have to pay the tourist tax in cash to the accommodation provider?

Not necessarily. The method of payment for the tourist tax can vary depending on the accommodation provider and the local regulations. In many cases, the tax can be paid by credit card, debit card, or other electronic payment methods. However, some smaller or independent accommodations might prefer or require cash payments. It's best to check with your accommodation provider in advance.

-

Do I need to register upon arrival at my hotel? Is this mandatory?

In Canada, there is no nationwide registration requirement for overnight stays, unlike in some European countries like the Netherlands, France, or Switzerland. However, certain cities in Canada may have local laws requiring guest registration. It's important to comply with any registration requirements that your accommodation provider informs you about upon arrival.

-

I have canceled my stay. Do I still have to pay tourist tax?

No, if you have canceled your stay, you are not required to pay the tourist tax. The tax is only applicable for stays that actually occur. If you have paid the tourist tax in advance, the accommodation provider has to pay you the tourist tax back.

-

Upon arrival at the hotel, I was asked to pay the tourist tax. But I already paid it through the booking platform. What should I do?

If you have already paid the tourist tax through the booking platform, you should not be required to pay it again upon arrival. In such cases, you can show the receipt or confirmation from the booking platform to the accommodation provider as proof of payment. If there is any confusion, you may need to contact the booking platform's customer service to resolve the issue.

For hosts

Renting-out in Canada: a lot comes with it

Whether you rent out your home once during a long vacation, do this more often, or as a professional business: as a landlord in Canada, you find yourself in a complex world of regulations. There is no overarching federal law, but all provinces and many municipalities set their own rules. From mandatory registration in Toronto to classification in Québec - local requirements vary.

Luckily, we are here to help you get started!

Taxes on renting out your accommodation

As a host in Canada, you have fiscal obligations at various levels. First, on a domestic level, you must declare your rental income to the Canada Revenue Agency for income tax. Provincial taxes form an additional layer: think of PST in British Columbia or QST in Quebec. Some municipalities also levy a tourist tax. Ensure accurate administration and consider hiring an accountant. Third, on a local level, tourist taxes might apply. This differs between and within provinces.

We write more about HST and sales tax rates per province earlier on this page.HST and sales tax rates per province

Collecting and remitting tourist tax in Canada

Each province and municipality have its own rules regarding collecting and remitting the tourist tax. In most cases, the responsibility for collecting the tourist tax lies with the landlord. Even when working with an intermediary, such as an online booking platform, it is expected that you handle the tourist tax yourself with your guests.

-

Changes in 2024 in Alberta

As of October 1, 2024, the rules regarding tourist tax in Alberta have changed. The rate of the Tourism Levy remains the same, but the responsibility for collecting, remitting, and administering the tourist tax has been adjusted. The responsibility is placed on the (legal) person who collects the payment for the accommodation from the tourist. In other words, when a tourist books and pays directly through an online booking platform (such as Airbnb), The online platform is required to collect and remit the tourist tax correctly to the Tax and Revenue Administration (TRA).

-

Nova Scotia changes legislation short-term rentals due to housing crisis

As of September 30, 2024, the rules in Nova Scotia have change to combat the housing crisis. All short-term rentals and/or other tourist accommodations that wish to remain active after October 1, 2024, must apply for a registration number. The cost for this ranges from $50 to $2000, depending on the type and size of the accommodation.

-

Classification of your accommodation in Québec

Every accommodation in Québec used for tourist purposes, including short-term rentals, must be registered with the Corporation de l'industrie touristique du Québec (CITQ).

The accommodation must be classified. To obtain this classification, the accommodation is inspected and evaluated based on standardized criteria such as facilities, cleanliness, and the service provided.

After registration, the landlord must apply for a permit through the CITQ to rent out the accommodation. The permit must be renewed annually and can be revoked if the accommodation does not meet the legal requirements, such as hygiene and safety. Think, for example, of the use of smoke and carbon monoxide detectors.

Don’t want to worry about remitting the correct amount of tourist tax?

That’s possible, with the use of Trippz!

-

Rules and regulations in Toronto

In Toronto, every short-term rental must register with the city. After registration, you will receive a registration number that you are required to include in every advertisement of your accommodation.

It is only allowed to rent out your principal residence as a short-term rental. An investment property is only allowed for long-term rentals. The threshold between short-term and long-term rentals is 28 consecutive nights. Additionally, it is only permitted to rent out a maximum of 3 rooms at the same time. Per calendar year, you may rent out your accommodation for a maximum of 180 nights.

-

Short-term rental rules in Vancouver

Just like in Toronto, landlords in Vancouver must register with the city to rent out their property as a short-term rental. Your registration number must be visible in every advertisement of your accommodation. In Vancouver, accommodations are considered short-term rentals when rented out for a maximum of 30 consecutive days.

In Vancouver, you may only rent out your principal residence. This is the property where you live most of the year and which you use for your mail, tax returns, and insurance. Vancouver does not impose a maximum number of nights per year, nor a maximum number of rooms per accommodation that you may rent out.

-

Insuring your short-term rental

Informing your insurer about your short-term rental activities is crucial. It is therefore recommended to take out a special short-term rental insurance policy to cover damages and liabilities.

Conclusion on short-term rental rules and regulations in Canada

The regulation of short-term rentals varies significantly between different provinces and cities in Canada. However, there is a clear trend towards more – and stricter – regulations. More provinces are introducing registration requirements and looking at the role of online booking platforms in the tourism sector. The Canadian legislator seems to be closely following developments in other countries, such as the tourist tax legislation in France.

It is important that, as a landlord, you know and comply with the specific rules and requirements for your location. Always consult the official websites of your municipality for the most up-to-date information.

Frequently asked questions from hosts

-

Can you receive fines if you don't remit tourist tax?

Yes, failing to pay the tourist tax can result in fines and penalties. Municipalities are responsible for enforcing tourist tax regulations, and non-compliance can lead to financial penalties, legal action, or other consequences as determined by local laws. This can result into fines of $100,000.

-

Am I required to request a rating for my accommodation?

It depends on the region you are active in. In certain regions, particularly in Québec, it is mandatory to obtain a classification for your accommodation if you offer it for tourist purposes. This classification involves an inspection and rating based on standardized criteria. However, in other provinces and municipalities, a rating or classification may not be required.

-

To whom should I pay the tourist tax?

Tourist tax is typically paid to the local municipality where your accommodation is located. The exact procedure for remitting the tax varies by municipality, but it often involves regular payments (monthly, quarterly, or annually) to the local tax office or through an online payment portal provided by the municipality.

-

Should I enclose the guest registration as proof when remitting tourist tax?

In some municipalities, you may be required to submit guest registration details as part of your tourist tax remittance process. This could include the number of guests, length of stay, and the total amount collected. However, this requirement varies, so it's important to check with your local municipality for specific procedures.

-

Should I enclose the guest registration as proof when remitting tourist tax?

In some municipalities, you may be required to submit guest registration details as part of your tourist tax remittance process. This could include the number of guests, length of stay, and the total amount collected. However, this requirement varies, so it's important to check with your local municipality for specific procedures.

-

Does my municipality have a special form for tourist tax remittance?

Many municipalities provide specific forms or online portals for remitting tourist tax. These forms typically require details about the amount of tax collected, the number of guests, and other relevant information. Check with your local tax office or municipal website for the correct form or online submission process.

-

How do I process the guest's earlier departure and tourist tax refund?

If a guest leaves earlier than planned, they are generally entitled to a refund of the tourist tax for the unused nights. You would need to adjust the total tax amount and refund the overpaid portion to the guest. Make sure to update your records and inform the local tax authority if required, depending on local regulations.

-

Do I declare per accommodation, or combine them all together?

This depends on your local regulations. Some municipalities may require you to declare and remit tax per accommodation, especially if they are located in different jurisdictions. Others may allow you to consolidate all accommodations under a single declaration if they are within the same municipality. Always check local guidelines to ensure compliance.

-

Do I also have to pay tourist tax on cancelled bookings?

Generally, tourist tax is not required for canceled bookings, as the tax is typically based on the actual stay. If a booking is canceled and no stay occurs, no tax is due. However, if a deposit or pre-payment was made that includes the tax, you may need to refund it to the guest or adjust your tax remittance accordingly.

-

How do I make this all as simple as possible?

To simplify the process, consider using specialized software or services that automate the collection, calculation, and remittance of tourist tax. Trippz is designed by and for hosts, so we can help streamline the administrative burden by integrating with booking platforms, automating guest registration, and handling tax payments on your behalf. Additionally, keeping detailed and organized records can help ensure accuracy and compliance with local regulations.

How Trippz helps hosts

Organize your administration simply

Classifying your accommodation, keeping a guest registry, collecting and remitting the correct amount of tourist tax; besides taking good care of your guests' travel, there is a lot of administrative work involved in renting out your accommodation. Work that you may not have even thought of initially when you started, and that you probably want to spend as little time on as possible. Therefore, you want to organize your administration as simply as possible.

And fortunately you can, with Trippz!

All in one overview

Trippz is here to make your life as easy as possible, while complying with all regulations. Through our (web)app you automate your guest registration, and you can even prepare your administration for the tourist tax. You don't have to worry about collecting the tourist tax either. Because we keep track of all local regulations, we know exactly what rate your guests have to pay. On arrival day, your guests will automatically receive a message from us to pay their tourist tax. At the end of their stay, the money will be automatically deposited into your account. All you have to do is periodically transfer the total amount to the municipality. Simple!

Automatically sync all Airbnb bookings

You can now synchronise all your Airbnb bookings with Trippz on your account. This means you have to do even less yourself. Ideal for hosts who rent out a lot via Airbnb. Do you rent through another platform? We expect to complete more integrations in the near future. Get in touch to find out if your platform will soon be added to Trippz.

Frequently asked questions about the use of Trippz

-

How does Trippz help me as a host?

Trippz makes it easy to comply with local guest registration and tourist tax rules. Our tool automatically collects the necessary guest information and calculates the right tourist tax, based on the local regulations. You no longer have to worry about manually updating spreadsheets, logging into government portals, or missing deadlines. Trippz takes care of the compliance work in the background, so you can focus on offering a great guest experience.

-

Is it difficult to start using Trippz?

Not at all! Trippz is designed to be user-friendly. It is developed as a web application, so you do not need to download an app. You can start right away!

-

What does the use of Trippz cost?

At the moment, it is free of charge! Have a look at our page for Hosts, to see the current pricing.

-

Can I use Trippz if I only rent occasionally?

Yes, absolutely. Trippz is built to support all types of hosts, from someone who rents out their home a few weekends per year, to professional property managers. Whether you're small-scale or manage multiple listings, Trippz adjusts to your needs and helps you stay compliant with minimal effor

-

Can I import all my bookings from Airbnb?

Yes, you can! We have worked on an integration with airbnb, through which you can automatically import all your bookings. Thereby, the messages about guest registration will also be send automatically through our platform.

-

Can I import all my bookings from my own booking system?

After the integration with Airbnb, we are now working on all other sorts of integrations. Integrating your own platform is not yet available, but will be in the future!

-

How does guest registration work for my guests?

Once a booking is confirmed, Trippz sends a registration link to your guest via email or platform message. The guest fills in a simple form, and you’re notified once it’s completed. You can review the details before they are submitted to local authorities. This ensures all data is accurate, and no extra logins or uploads are needed on your side.

-

Does Trippz collect the tourist tax for me?

Yes. Trippz now collects the tourist tax directly as part of the check-in process. Once your guest has completed their registration, the correct tax amount is calculated and securely collected. You don’t need to handle any payments yourself. Periodically, you’ll receive a payout with an overview of the amounts collected and remitted, keeping everything clear and compliant.

-

What if a guest doesn’t want to register digitally?

This is an unfortunate situation, that does happen from time to time. If a guest does not want to enter digitally, you can manually enter their details into Trippz afterwards.

-

What if my municipality changes the tourist tax rates?

At Trippz, we actively follow all tax rates in areas that we cover. When a new tax rate is implemented, we will update the rates accordingly. Still missing something? Please reach out to us!

-

What happens if my municipality collaborates with another one?

No problem. As said, we actively follow all municipalities and their rules. We will automatically update this for you. If you want to be sure, you can always message us in advance, so we are even more on top of things!

-

How does it work if another organization manages the tax in my municipality?

With Trippz, you can export all the information you need. You can easily copy the needed information towards the file the tax organization requires from you.

municipality