New Zealand increases its tourist tax – what is happening?

A lot of media outlets have been reporting about the increase of the International Visitor Conservation and Tourism Levy (IVL). But what does this mean for tourists and local taxpayers? We will explore why the tax is increasing, how it works, and whether other tourist taxes are on the horizon.

The rise of tourism in New Zealand

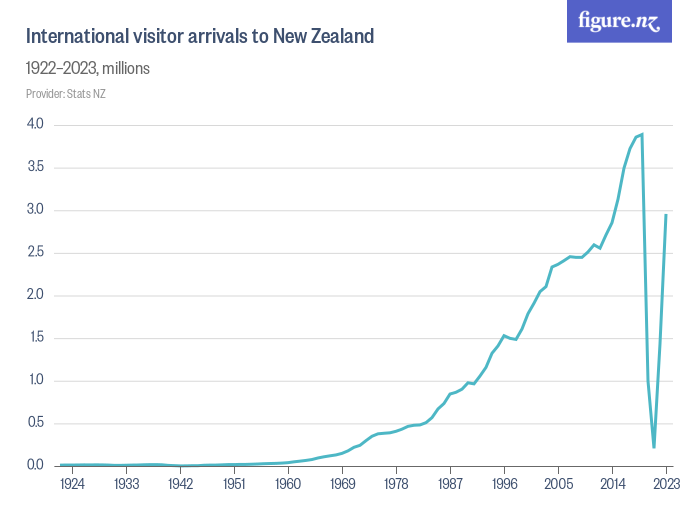

More and more people want to have seen the beauty of New Zealand. This can be seen in the sharp increase of the number of international visitors of New Zealand, though COVID caused a significant drop. Since the borders have been reopened, New Zealand has seen a strong rebound in tourism.

Source: Figure.nz

Source: Figure.nz

The introduction of the IVL

Tourists use public infrastructure, like roads and public transport. Maintaing the infrastructure, costs quite some money. In 2019, New Zealand introduced the IVL to ensure international visitors were contributing directly to these costs, which were previously funded by local taxpayers. The rate was set at 35 NZD (around €19.50).

Why the IVL is increasing in 2024

Despite the IVL, the government of New Zealand believes too many costs imposed by international visitors are still paid by their citizens. Therefore, it will be raised to $100 (€56.00) from October 1, 2024.

Other tourist taxes in New Zealand

In many countries, tourists pay a tax based on their overnight stays, unlike New Zealand's entry-based International Visitor Levy. Currently, there are no local taxes or nightly fees for tourists in New Zealand, but discussions are underway about introducing a "bed tax." Auckland's mayor has proposed implementing it nationwide. Other municipalities are seeking additional ways to generate revenue locally. Thereby, a recent poll revealed that 58% of New Zealanders believe giving local governments more financial tools would improve their effectiveness.

Sustainable tourism in the future?

As we see in other countries, a lot is happening around the sustainable management of tourism in New Zealand. As Trippz, we follow developments closely. On the one hand, to keep the data on our platform up to date, but also to further sharpen our vision on tourism management, and supplying governments with the right tools to combat overtourism